When it comes to the creation of digital art or media, risk can be talked about in two different ways. One way is to discuss it through the lens of the danger of the content. A work or product that is confronting something contentious in society or culture can often be considered a risky endeavor for an artist at any level of their career. This kind of risk could partially be the result of creating something contrary to the rest of an established way of working—for example making essayistic videos about war after having been a successful abstract painter. Or this risk could be a constant pursuit of creative alternative or subversive artworks that continually challenge the status quo.

However, the content of an artwork is only one possible way to gauge its risk. The other way is to talk about risk from a financial standpoint: evaluating the worth or value of a work prior to its execution based upon prior success and other market indicators. This type of risk has increasingly been discussed with regard to digital art due to the ways in which artists working in this vein (under a loose network of affinities with post-Internet, netart, or new media communities) have become associated with start- up culture or Silicon Valley innovation. Many of the links between digital art and start-ups are based on the similar channels and infrastructure in which these systems proliferate and are distributed. Yet another shared connection between the two communities and cultures revolves around an entrepreneurial spirit for brand building.

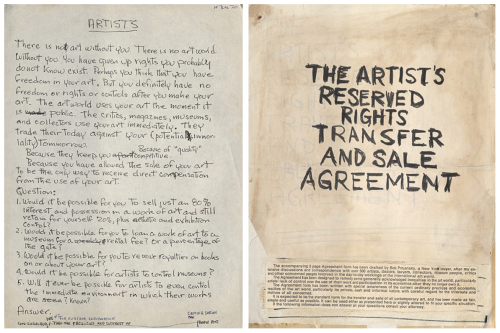

Handwritten draft of Artist Contract by Seth Siegelaub. Courtesy of the Internet.

As network technology has become an essential financial institution for the decentralized distribution of goods and services (including labor and media), artists and businessmen alike have found ways of working around old-world regulatory bodies to gain direct access to consumers and audiences. In other words, where businessmen are turning away from standard business models, artists are turning away from traditional gallery models. In doing so, both seek to use the Internet as a shortcut to gain direct access to their “market audience” in order to deliver content in a more immediate way. Although many businesses have thrived in providing more direct services to their audiences and consumers, many artists are still struggling to find a concrete way of capitalizing on adopting new models. This is where looking at risk—from a fiscal perspective—can potentially illuminate the problems of modeling cultural production after so-called innovative business strategies.

In an essay entitled Startup = Growth, programmer and investor Paul Graham discussed why venture capitalists interested in incubators and innovation are drawn into these industries. He states that one primary reason is that regardless of high risk in these companies, the potential return of profit or dividends can far exceed initial investment. For high-growth companies like start-ups the return on investment is also becoming easier and easier to guarantee— whether that be through an IPO offering or by company acquisition. For the producers within these industries, the risk of their efforts and labor is mitigated by this increasing guarantee. Also, most start-ups seeking funding that utilize their risk are already generating some kind of profit. According to Graham, the extra funding from venture capitalism is usually for insurance, or otherwise to maintain and “choose” the growth rate of production.

Understanding that growth determines the risk and valuation of a product is often overlooked within the contemporary digital art marketplace. For start-ups the risk of their company is often offset by investment, but digital artists tend not to get the luxury of this insurance. Instead, the risk of production is allocated to one of two precarious locations: the artist themselves or their audience.

Contemporary artists have turned to crowd-based philanthropy services like Kickstarter and Indiegogo as a way of generating funds that otherwise would come from traditional patronage. One benefit of these platforms is that they can operate as a way of gauging interest in production for an artist seeking new audiences. But because the growth of these campaigns is still determined by consumers, the risk is never fully redistributed away from the producer (as it is with VC funding). Furthermore, when an artist turns to these platforms (as opposed to a gallery or state-run granting organizations) they are placing the burden of risk directly onto their audience. The decentralized patronage of an artist’s network (or by the sponsorship of strangers) is only a way of creating temporary insurance against the risk of producing a new work.

Instead of leveraging the power of network technology to reach new audiences, implementing crowd-based funding strategies eventually leaves artists in the same precious state from which they started. The temporary nature of this funding doesn’t inherently provide long-term ways of generating revenue, as is the case with start-ups seeking investment. Whereas VC funding creates insurance against risk, crowd-based funding only further entrenches an artist into a risky position. Part of this has to do with the kind of dividends and returns that art production can afford to investors. Part of this also has to do with the responsibility that artists have to their funders. The contract that is formed between artists and their crowd-funders is one that does not mimic the high-growth return on investment found in start-up innovation. To put it another way: an artist’s work on Kickstarter will never become an IPO.

That being said, the other option of acquisition for return on investment within high-growth/high-risk investment is still available. However, the potential for that metaphorical “buyout” does not benefit the backers of a project or help an artist manage risk. For the majority of collectors, an artist’s risk is only measured at the point of acquisition, since the valuation of their asset is based on market demands and its potential for resale. For artists participating in the marketplace, the prospect of collection often becomes the driving force for production. Collection and acquisition are not insuring the risk or value of an artist based on their growth. Instead, they are exploiting an artist’s production for personal profit.

In this way, playing the market or courting collectors is as equally precarious as adopting innovation-based funding strategies. In each methodology the risk for the artist remains high with a low or limited return on investment for patrons. While the fiscal rhetoric of start-ups has infiltrated the vocabulary of contemporary digital artists, the reality of co-opting these strategies to create financial independence is still very far off. An underlying problem with this discrepancy lies in the different ways that businessmen and artists handle their property. For a start-up, the intellectual property of a company’s production is heavily safeguarded. For an artist, intellectual property often gets absorbed and dissipates at the point of distribution. A start-up can release and sell products over and over while maintaining their intellectual property through end user licensing agreements (EULAs). The artist does not have such contracts at their disposal.

Even if a digital artist adopts copyright regulations or releases his or her work through creative commons, the way in which that work circulates is often out of the hands of the producer. The distribution of cultural products is much more nebulous (and at times more prolific) than the intellectual property of innovation incubators. Artworks that traverse many networks often lose their point of origin, and frequently lose author citation or accreditation. It goes without saying that the majority of digital art consumed is in fact under the thumb of regulatory EULAs enforced by social media platforms like Tumblr or YouTube. Even if an artist could accurately oversee and maintain the distribution of their work, finding direct ways to monetize that circulation might go against the EULA of a social media platform.

Again, the problem arises that even in rare moments when an artwork returns a high yield of distribution, the risk of the production of that work remains on the artist. Attention economies do not provide insurance against risk. In some cases it works quite the opposite: works that break into mainstream attention economies can work against the growth of an artist, pigeonholing them into a type of production that might be less risky but also creatively limiting. The success of innovative artworks that reach a wide audience is no substitute for the ways that VCs helps a company manage their growth.

This being said, the prospect that VCs might be able to help an artist manage his or her intellectual property, and as a result assist an artist in choosing how they grow, is a problematic assumption. Where VCs find value is not in determining how effectively their investment will assist in a product to manage its growth. Instead, valuation of start-ups and their intellectual property is based on how quickly production will return high dividends. Art fundamentally does not work this way. Even if a work or an artist grows quickly, the return on investment is never fully guaranteed, and even if it were that value could be flipped for further profit after acquisition.

Although the rhetoric of start-up business practices has taken root in digital art production and distribution, their similarities are only skin deep. Looking at the ways in which risk is measured, mitigated, and leveraged within a start-up model shows stark differences between the ways that each industry attempts to generate funds for sustained production. Where start-ups use funding platforms like venture capital for insuring the long-term maintenance of growth for a company, artists cannot bank on such models. Instead, artists should reconsider how they use a term like risk to identify the value, meaning, and impact of their work within culture. Hopefully in doing so artists working with digital media will find new sources of investment where the financial risk of their work becomes manageable.